Homeowners Insurance in and around Guilford

Looking for homeowners insurance in Guilford?

Help cover your home

Would you like to create a personalized homeowners quote?

- Branford, CT

- Madison, CT

- North Branford, CT

- Clinton, CT

- New Haven County CT

- Middlesex County CT

Insure Your Home With State Farm's Homeowners Insurance

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance is necessary for many reasons. It protects both your home and your precious belongings. In case of a burglary or vandalism, you may have damage to some of your possessions in addition to damage to the actual house. If you don't have enough coverage, you won't get any money to replace your things. Some of your valuables can be insured against damage or theft outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

Looking for homeowners insurance in Guilford?

Help cover your home

Don't Sweat The Small Stuff, We've Got You Covered.

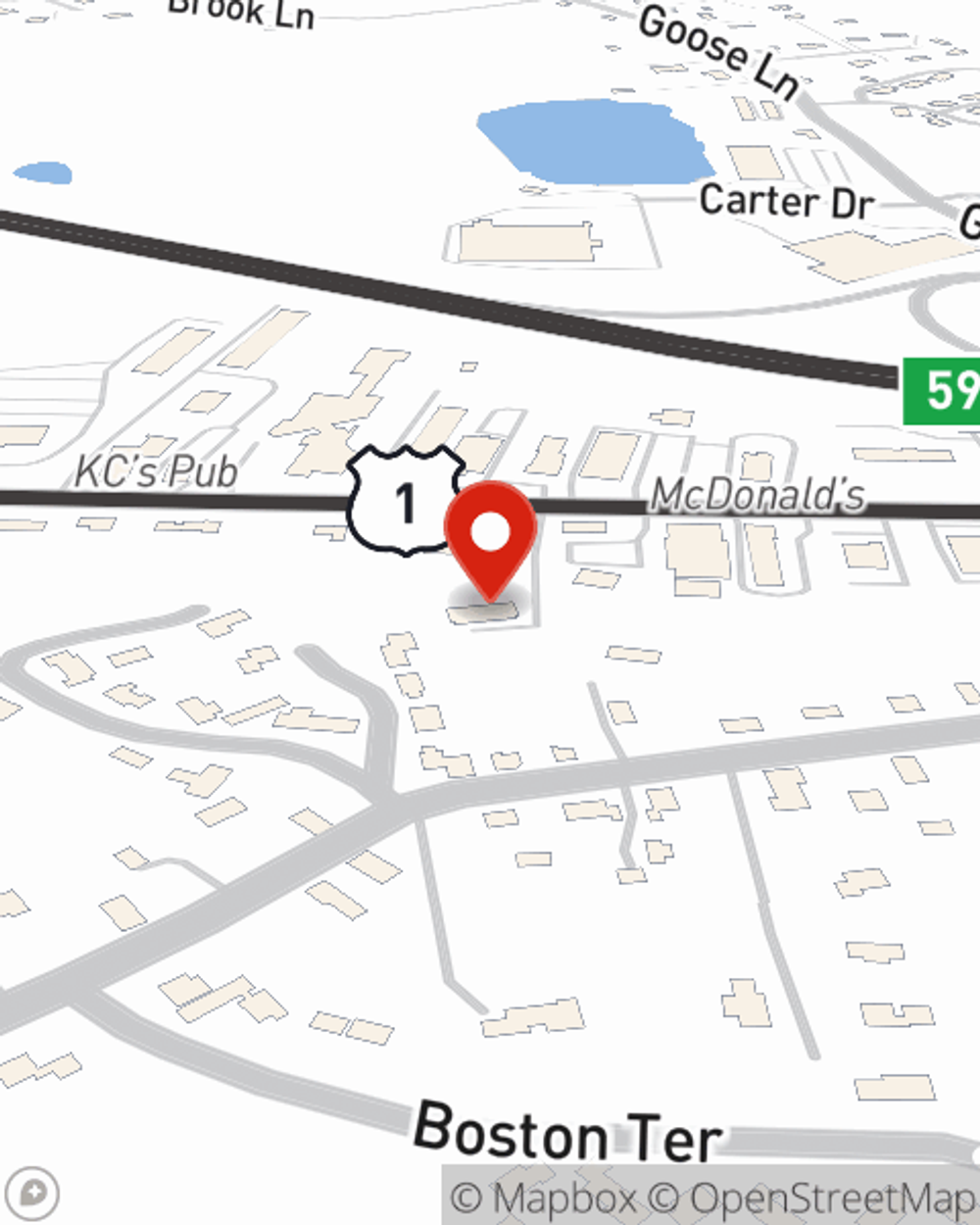

Great coverage like this is why Guilford homeowners choose State Farm insurance. State Farm Agent Craig Tracz can offer coverage options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or service line repair find you, Agent Craig Tracz can be there to help you file your claim.

Ready for some help getting started on a homeowners insurance policy? Visit agent Craig Tracz's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Craig at (203) 204-1421 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.

Ways to stay safe during a severe storm or wind event

Ways to stay safe during a severe storm or wind event

Severe weather and wind are common throughout the country. Read these severe weather safety tips to help with your emergency planning.

Craig Tracz

State Farm® Insurance AgentSimple Insights®

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.

Ways to stay safe during a severe storm or wind event

Ways to stay safe during a severe storm or wind event

Severe weather and wind are common throughout the country. Read these severe weather safety tips to help with your emergency planning.